Source Documents

Includes Statutes & Regulations, IRS Agency Documents, State Primary Source Documents, and Treaties.

The available Index links display next to the content links.

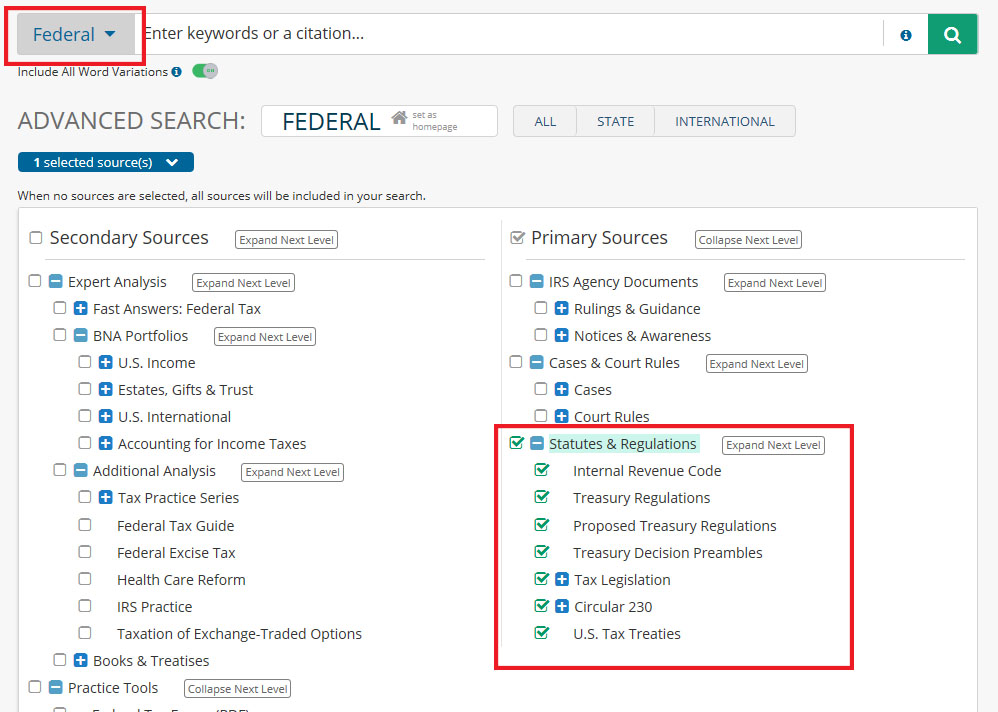

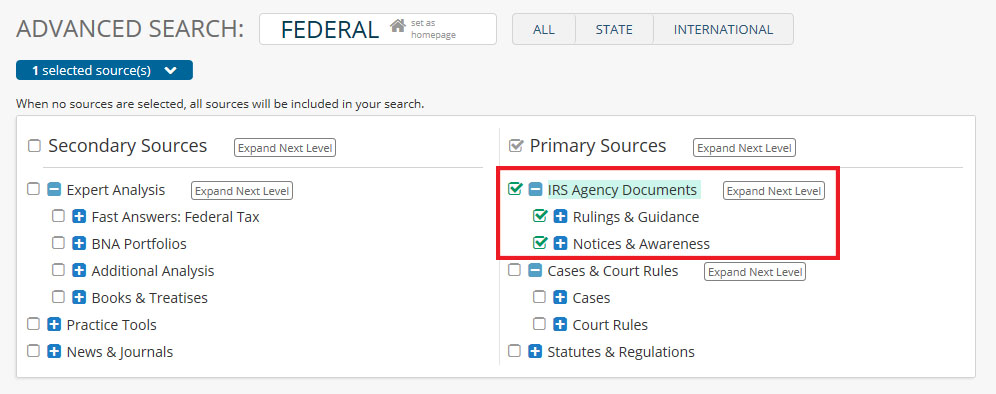

Use Advanced Search to simultaneously search in multiple Source Document files.

Federal Sources include:

- Internal Revenue Code (IRC): Annually 1986-Present, 1954, 1939, 1913

- Treasury Regulations

- Proposed Treasury Regulations: Back to 1980

- Treasury Decision Preambles: 1990 to present

- Tax Legislation: 99th Congress (1985-1986) to present

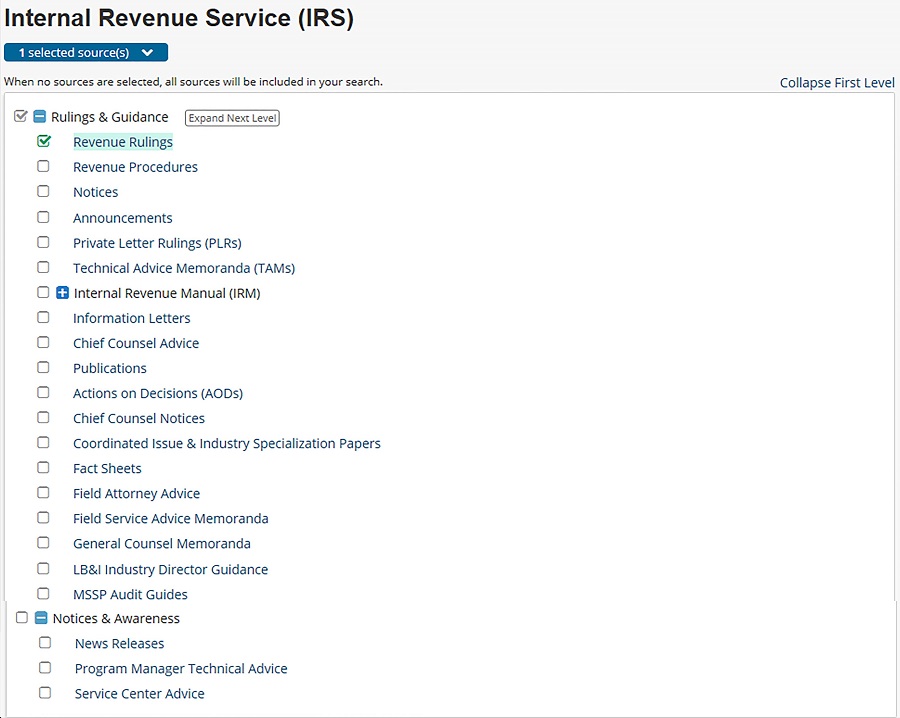

- Revenue Rulings: 1954 to present

- Revenue Procedures: 1955 to present

- IRS Notices: 1980 to present

- IRS Announcements: 1970 to present

- Private Letter Rulings (PLRs): 1980 to present

- Technical Advice Memoranda (TAMs): 1980 to present

- Internal Revenue Manual

- Chief Counsel Notices

- Coordinated Issue & Specialization Papers

- Fact Sheets

- Field Attorney Advice

- Field Service Advice Memoranda

- General Counsel Memoranda

- LB&I Industry Director Guidance

- MSSP Audit Guides

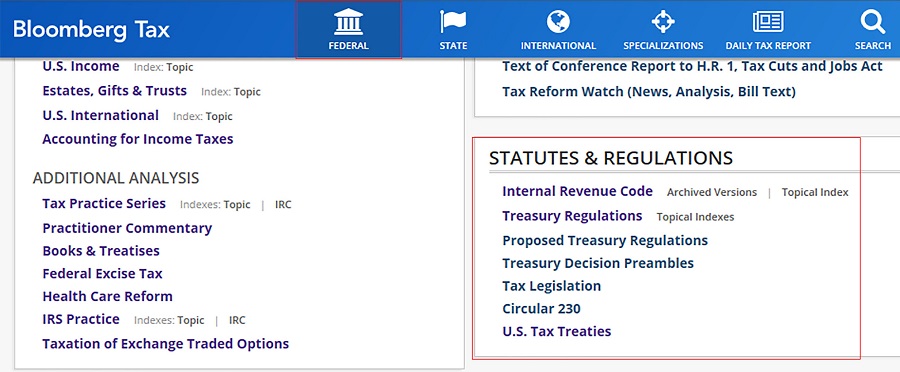

Statutes & Regulations

Browse and search for Federal statutes and regulations including the Archived Versions of the Internal Revenue Code.

Search multiple files simultaneously using Advanced Search.

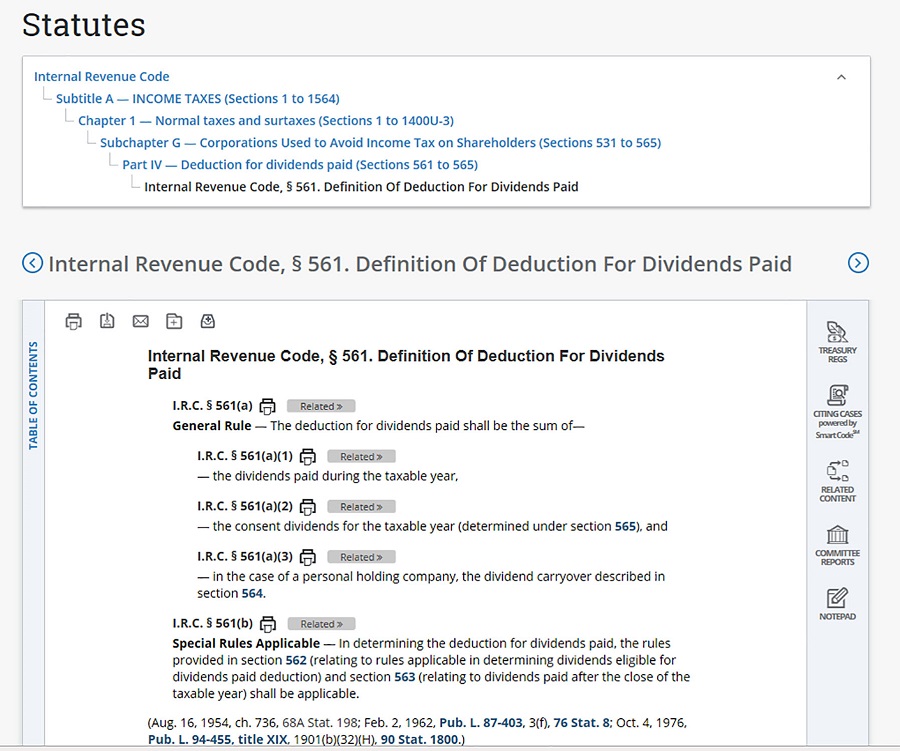

Statute Page

There are a number of optional icons that display with statutes:

![]() Treasury Regs. Link to the regulations associated with the statute.

Treasury Regs. Link to the regulations associated with the statute.

![]() Smart Code analysis.

Smart Code analysis.

![]() Committee Reports. Link to the committee reports associated with the statute. Committee Reports are incorporated into the Legislative History.

Committee Reports. Link to the committee reports associated with the statute. Committee Reports are incorporated into the Legislative History.

![]() Legislative History

Legislative History

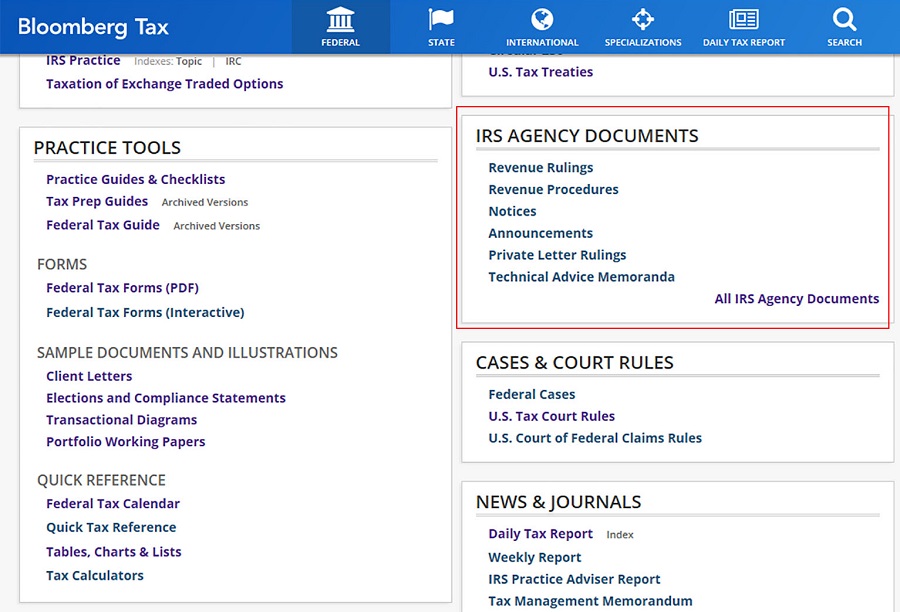

IRS Agency Documents

Click All IRS Agency Documents to view and browse all document types, including the Internal Revenue Manual.

Search selected documents by selecting individual collections.

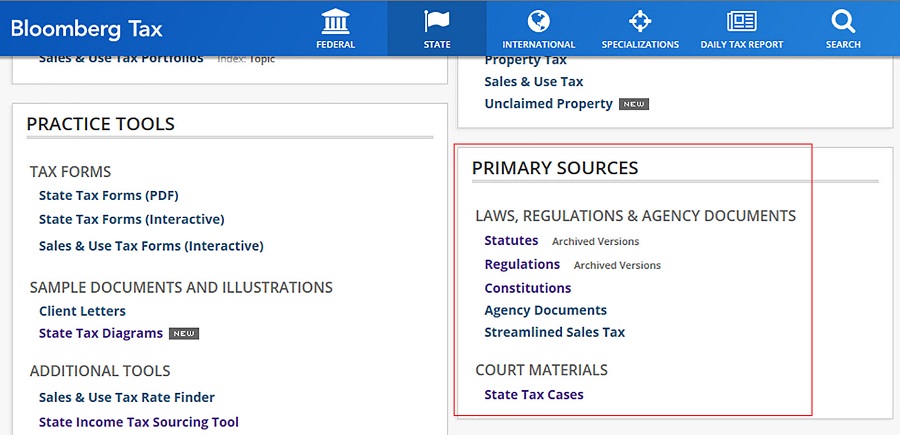

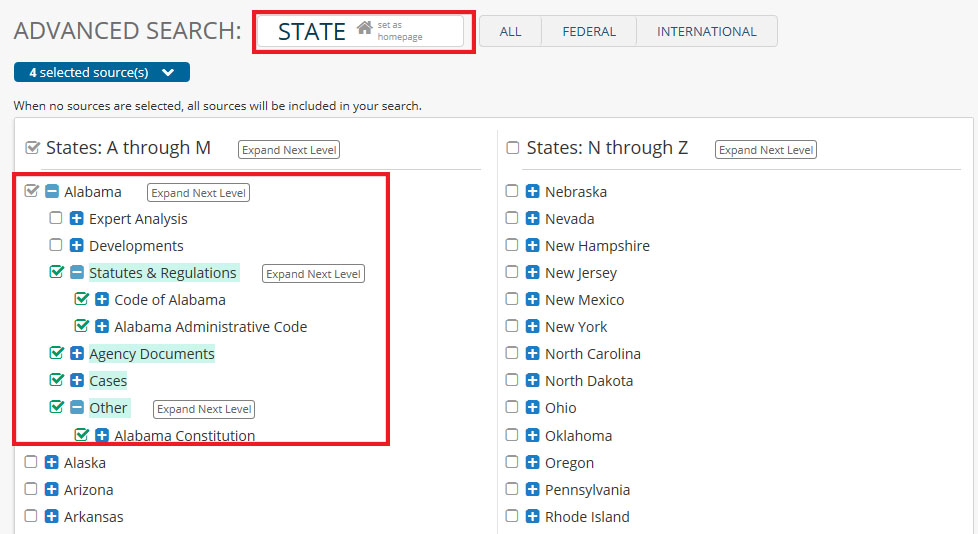

State Primary Sources

Link to State Statutes, Regulations & Constitutions, Agency Documents, and State Tax Cases. Archived versions are available for Statutes & Regulations.

To search states simultaneously, use the Advanced Search template. Select specific states from the Statutes, Regulations or Constitutions drop-down menus.

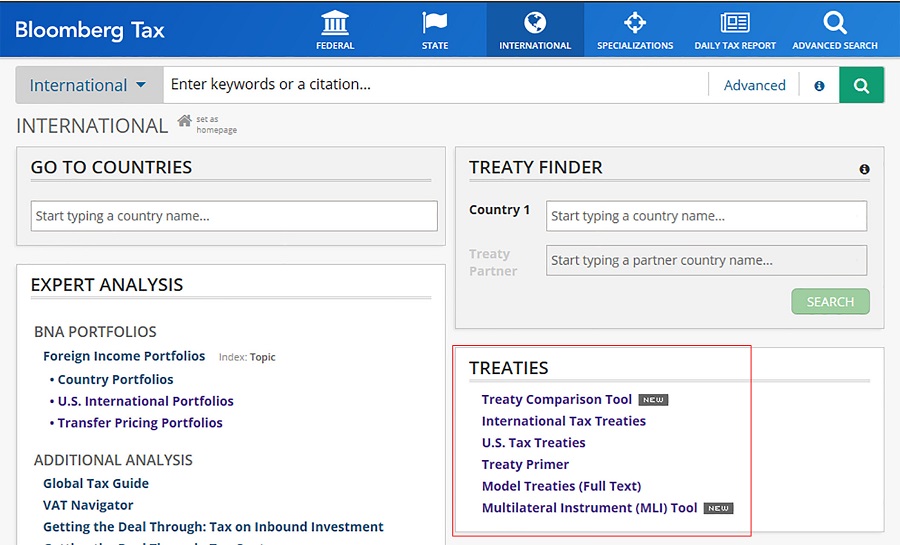

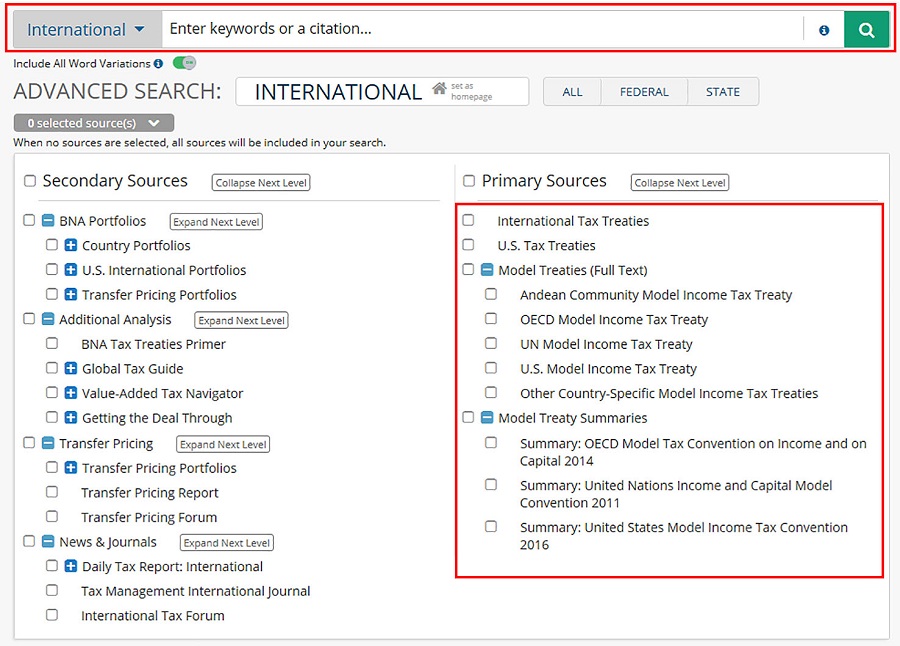

International Tax Treaties

Find U.S., International, and the full text of Model Treaties in the TREATIES frame.

International Tax Treaties and U.S. Tax Treaties include treaties in force, not-in-force and terminated treaties.

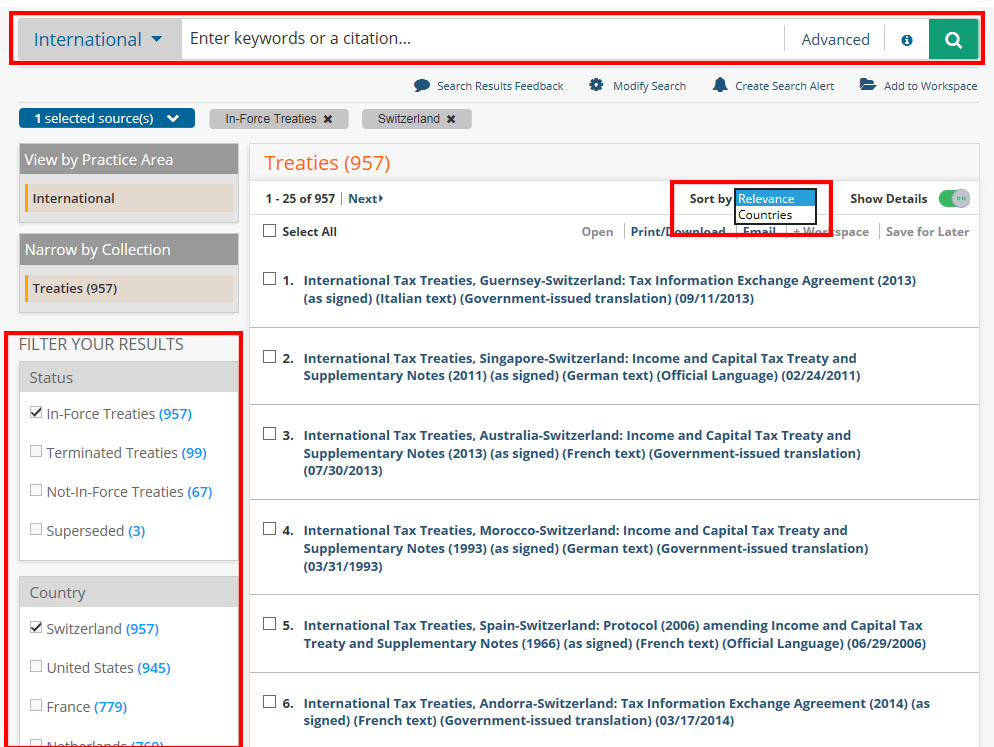

INTERNATIONAL TAX TREATIES

Click International Tax Treaties and access more than 17,000 treaty documents including: Competent Authority Agreements (English and non-English), Consolidated (BBNA issued), Consolidated (Government issued), Exchange of Notes (English and non-English), FATCA Agreements (English and non-English, FATCA MOU, MOU (English and non-English), Protocols (English and non-English), Technical Explanation and Ratification Documents (English and non-English), Treaty as signed (English and non-English).

Sort the results by Relevance or Countries and/or filter the documents by: Status, Country, Partner Country, Document Type, Topic, or Language to narrow the collection.

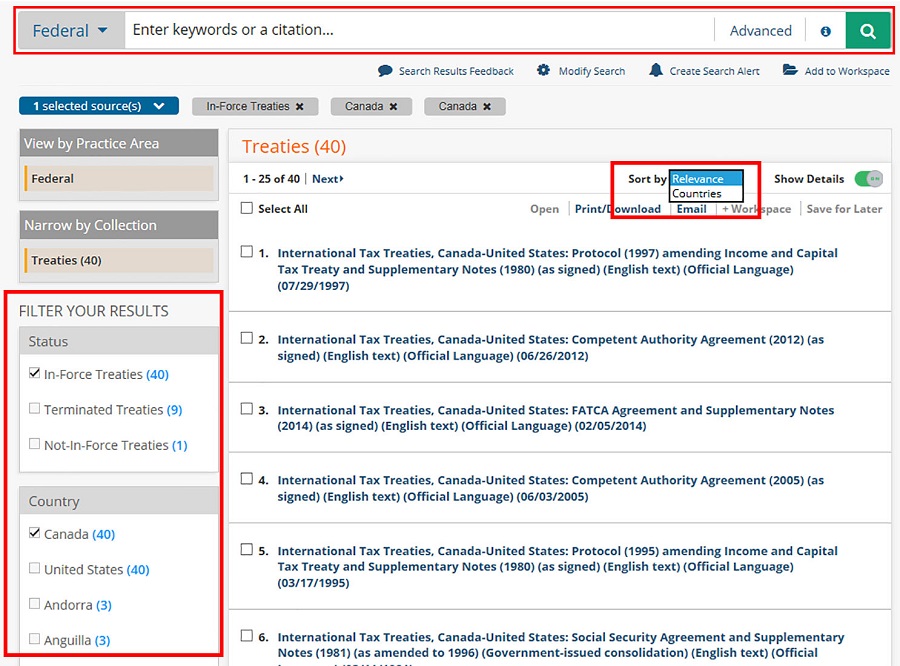

U.S. TAX TREATIES

Click U.S. Tax Treaties and use any or all of the filters: Status, Country, Partner Country, Document Type, Topic, or Language. Sort the results by Relevance or Countries.

ADVANCED SEARCH

Use the Advanced Search International template to search selected content within the Treaties collection.

Select the relevant content collections, enter your search terms, and [Enter] or click the Search button  .

.

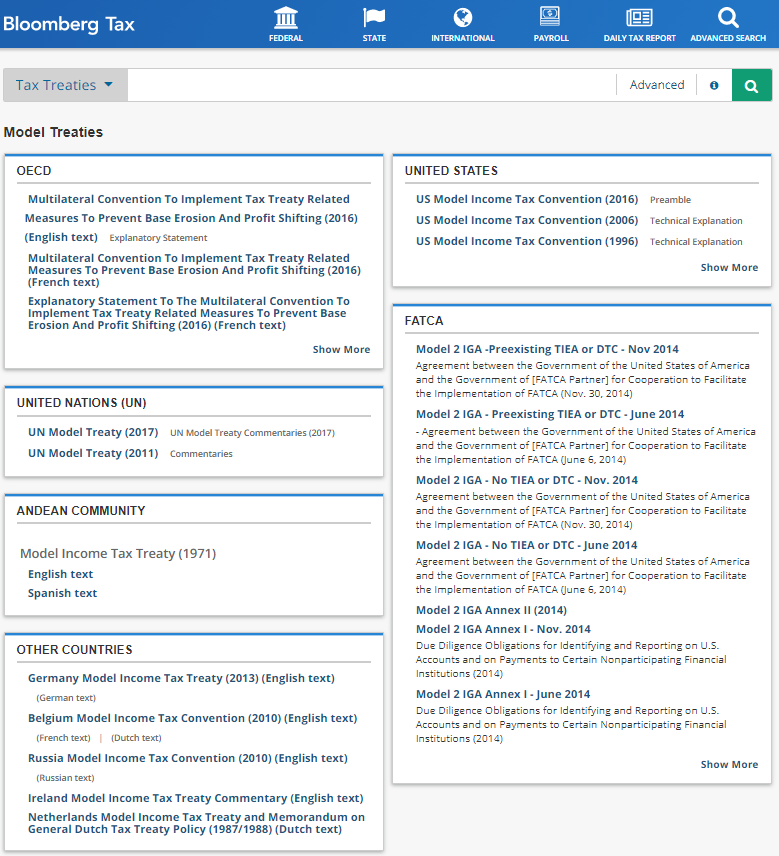

Model Treaties

MODEL TREATIES

The Model Treaties collection includes the full text and summaries. The treaty summaries include: OECD, UN, and U.S. Model Treaty Conventions and Commentaries, including OECD Model Tax Convention on Income and Capital July 2014, United Nations Income and Capital Model Convention 2011, and US Model Income tax Convention 2016.

The Model Treaties available as full text are:

Andean Community Model Income Tax Treaty

OECD Model Income Tax Treaty

UN Model Income Tax Treaty

US Model Income Tax Treaty

Other Country-Specific Model Income Tax Treaties