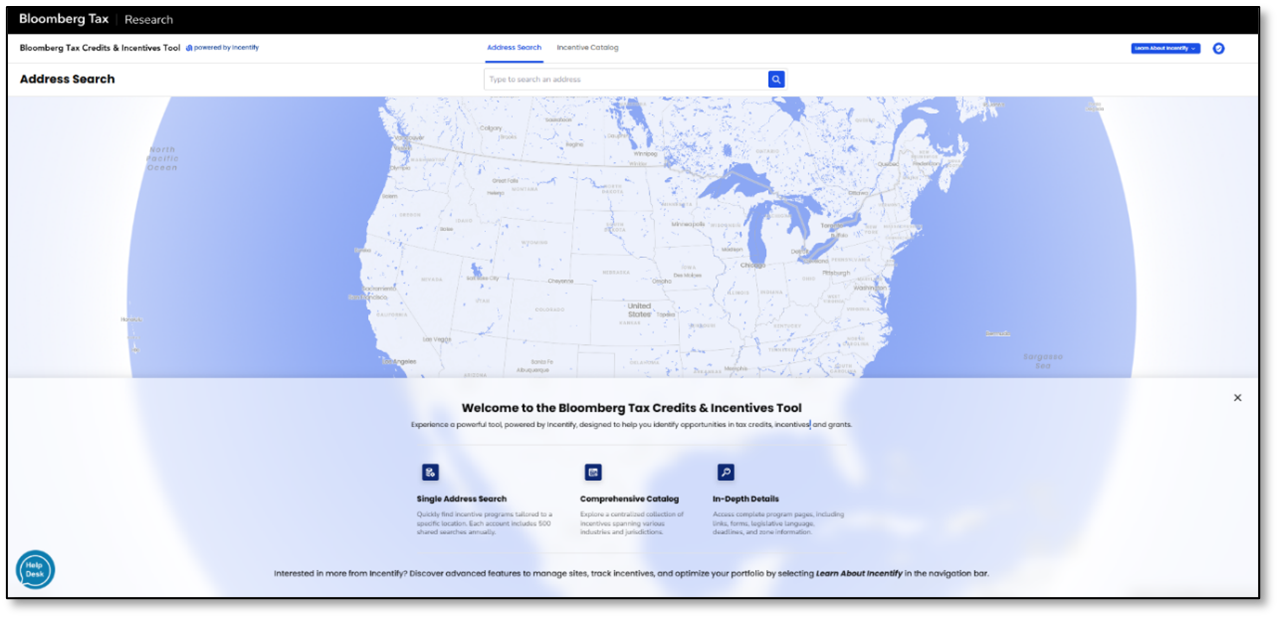

Bloomberg Tax Credits & Incentives Tool, powered by Incentify

How to Access the Tool

Bloomberg Tax users can access the Bloomberg Tax Credits & Incentives Tool directly through the Federal and State tabs under Practice Tools. Click on Credits & Incentives Tool.

Accessing Bloomberg Tax Credits & Incentives Tool

- Click the Credits & Incentives Tool link under Practice Tools in the Federal and State tabs.

- A brief loading screen appears while identity is confirmed.

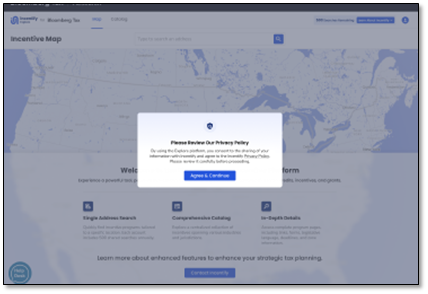

- First-time users see the Privacy Policy modal

If authentication fails or takes longer than 10 seconds, an error message appears with the option to return to the Bloomberg Tax environment.

Privacy Policy Acceptance

On first login, users must review and accept Incentify's Privacy Policy to comply with data regulations.

Key details:

- A full-screen modal appears on first login.

- A brief legal summary is shown, with a link to the full Privacy Policy in a new tab: https://eula.incentify.com/privacy-policy/

- Click Agree & Continue to proceed.

- Acceptance is recorded; users are not prompted again.

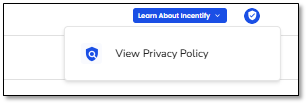

Accessing the Privacy Policy Later

At any time, users can hover over the profile avatar (top right corner) and click the Privacy Policy link in the popup menu.

Account Functions

Address Search

The Map is the first page users land on within the Credits & Incentives Tool. It serves as the core functionality hub, allowing users to search for any address and instantly match it with available incentives based on its location.

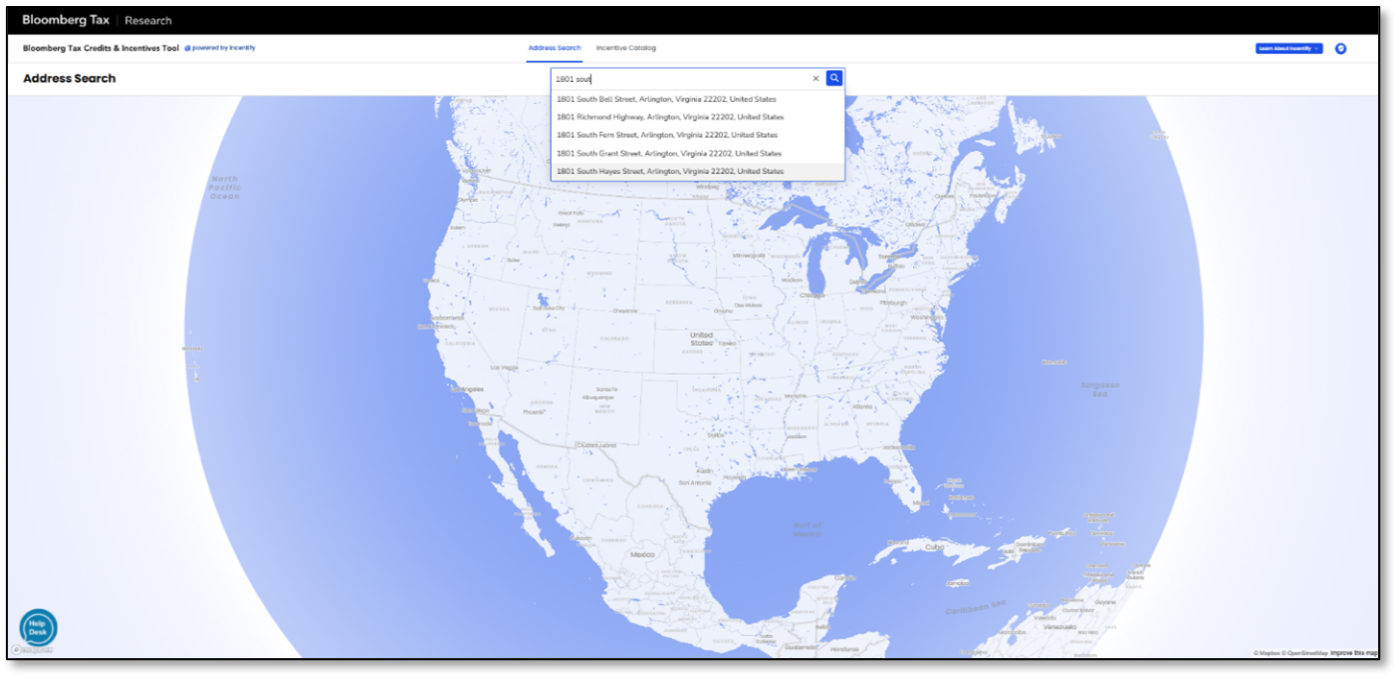

Entering an Address

- Click the search bar and start typing; suggestions are powered by Mapbox.

- Currently, only U.S. addresses are supported.

- Canadian and other international coverage is planned for future updates.

- Press Enter or Search to load the Summary Map.

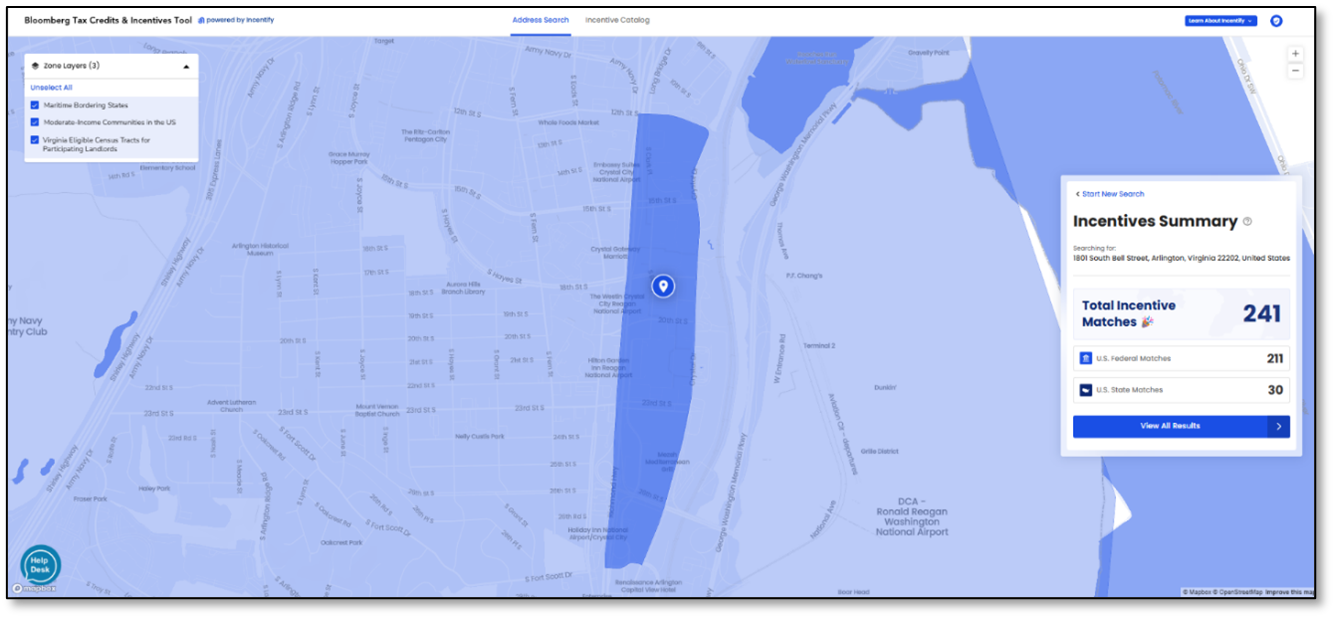

Summary Map

The Summary Map provides a high-level overview of the number of federal and state incentives available for the entered address.

Zone Boundaries: If the address falls within a qualifying incentive zone, the map will display boundary layers over the pin to indicate eligibility.

Results List

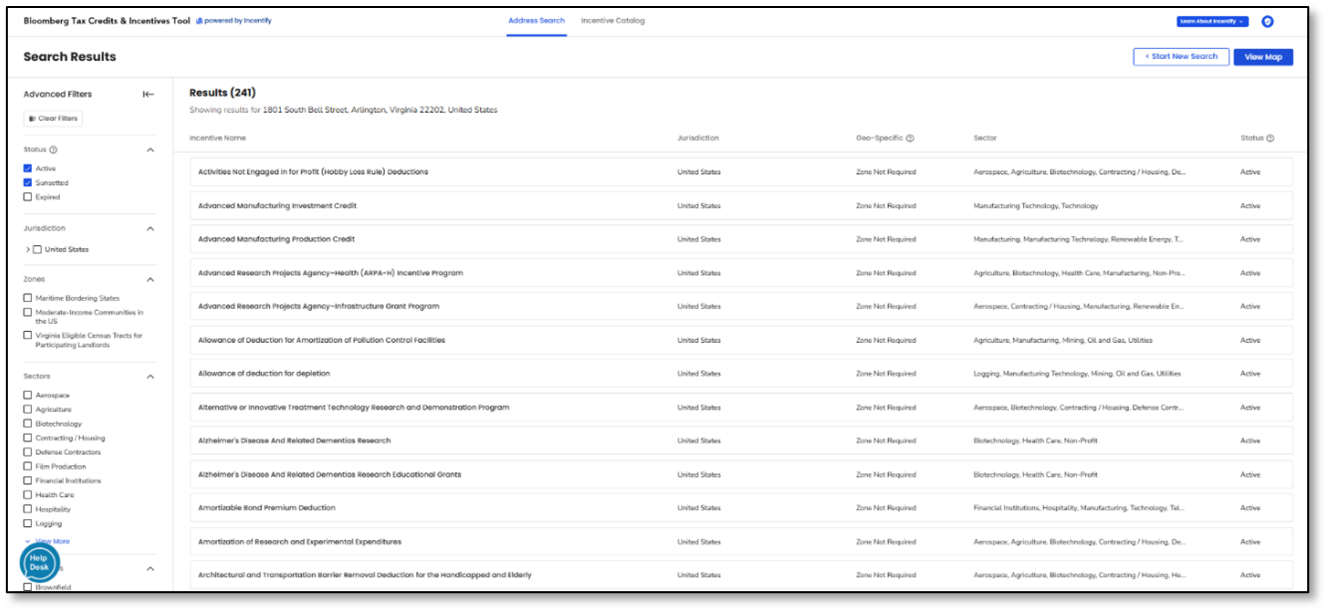

Click 'View All Results' to see the full incentive list for the address.

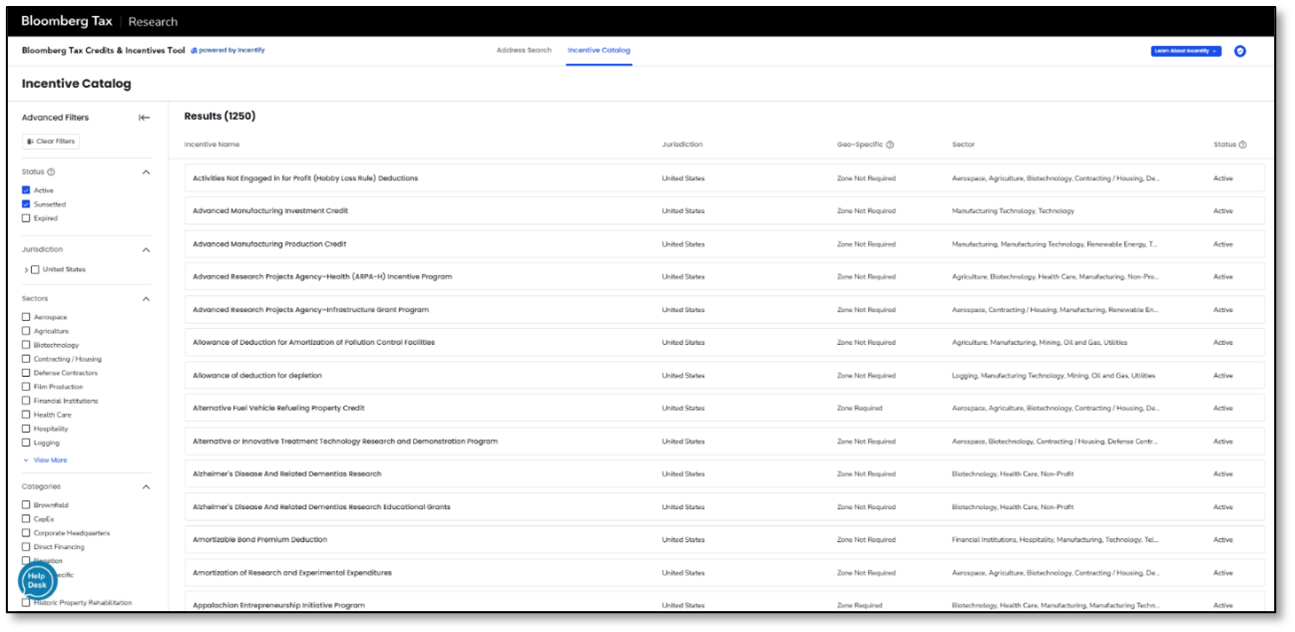

Advanced Filters

Explore offers a range of filtering options to refine results.

Default Filter Settings

- The Status Filter is enabled by default, filtering out expired incentives (users can include them if needed).

- Active and Sunsetted incentives are selected by default.

Understanding Filter Options

Filter options mirror the columns in the table and adjust their display based on the number of available options:

- Fewer than 10 options: All options are shown immediately.

- 11 to 50 options: A "view more" button appears to expand the list.

- More than 50 options: A search bar is displayed. Initially, up to 50 options appear after users type a character; additional options are revealed as users type more matching characters. Once selected, filters are displayed as chips for easy tracking.

| Filter Option | Description |

|---|---|

| Status | ● Active: Available to pursue; either no sunset date exists, or the sunset date has not yet passed. ● Sunsetted: The sunset date has passed, but benefits may still be claimed retroactively or through carry-forward provisions, where applicable. ● Expired: No longer available; the sunset date has passed, or the program has been repealed, and benefits can no longer be claimed. By default, the fi_lter includes "Active" and "Sunsetted." To view expired incentives, select the "Expired" option._ |

| Jurisdiction | Filters incentives based on jurisdictions tied to searched addresses (e.g., U.S. Federal & State). |

| Zones | Filters incentives based on the zones applicable to the searched address. |

| Sectors | Filters incentives based on applicable industries, such as Aerospace, Agriculture, Biotechnology, Contracting/Housing, Film Production, etc. |

| Categories | Filters incentives based on applicable categories, such as Brownfield, CapEx, Direct Financing, Hiring, Increased Production, Investment, etc. |

| Program Type | Filters incentives by type, such as Abatement, Deduction, Exemption, Fund, Grant, Liability Offset, Nonrefundable Credit, etc. |

| Tax Offsets | Filters incentives based on the types of taxes they offset, such as Ad Valorem Tax, Business Privilege Tax, Business & Occupation (B&O) Tax, Corporate Income Tax, etc. |

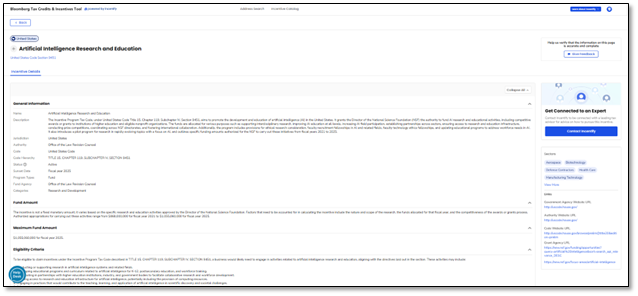

Incentives Detail Pages

The Incentive Details page provides all relevant and specific information about an incentive program.

How to Access the Incentive Details Page:

- Click on any incentive card row.

- The Incentive Details page will open.

Each Incentive Details page includes:

Header

- Incentive name and a link to the relevant section of the tax code.

- A list of applicable sectors, plus links to government agencies, authority websites, tax code resources, or grant fund websites, displayed on the left side.

General Information

- Jurisdiction

- Description

- Authority

- Tax code and code hierarchy

- Status (active, sunsetted, or expired)

- Sunset date

- Program types

- Relevant agencies

- Tax offsets

- Categories

Incentive Details

- Transferability

- Recurrence

- Recapture

- Retroactive / Retroactive Years

- Carry Forward / Carry Forward Years

Carry Back / Carry Back Years

Additional Details

- Amount - Value of the program per applicant.

- Maximum Amount - Program cap, if applicable.

- Eligibility Criteria & Questions - Helps assess qualification for the incentive.

- Qualified Expenditures - Lists eligible expenses.

- Limitations - Specifies restrictions or conditions.

- Recapture Details - Explains when funds must be repaid.

- Pass-Through Treatment - Defines application to pass-through entities such as partnerships and S-corporations.

- Application & Certification - Steps and requirements for application and certification.

- Filing Requirements - Required forms and submission processes.

- Compliance Requirements - Regulations for maintaining eligibility.

- Contact Information - Official points of contact for inquiries.

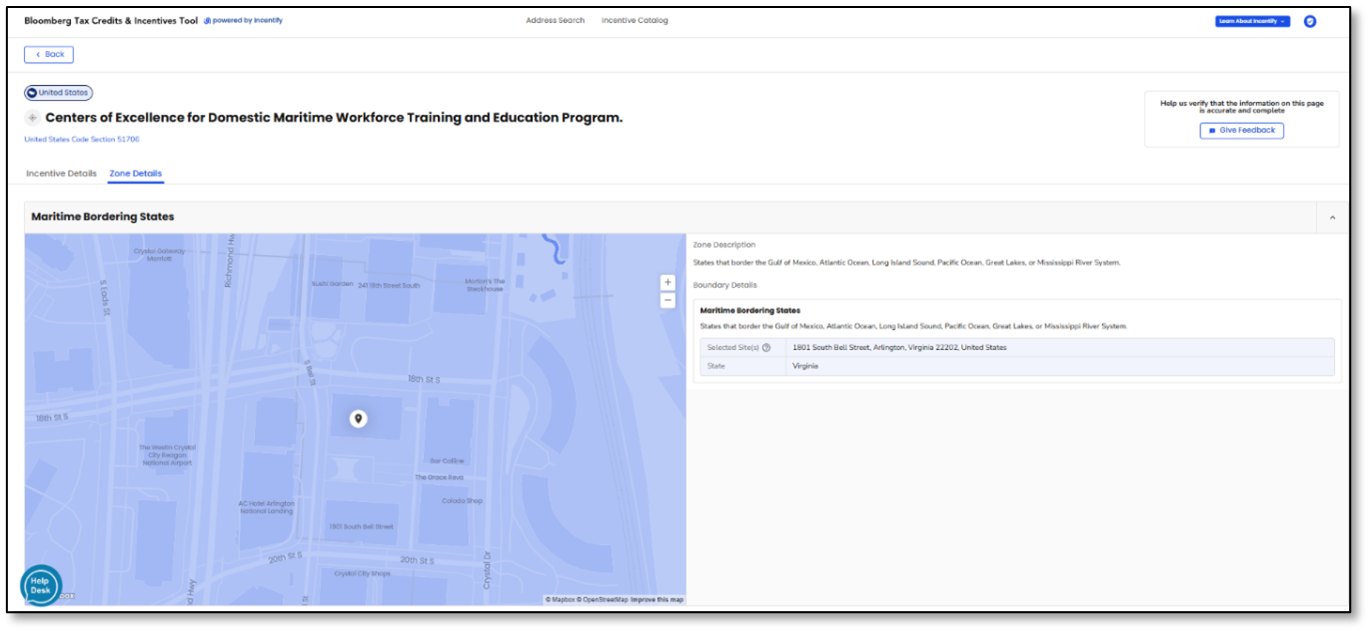

**Zone Details

**

The Zone Details tab displays all zone-related information relevant to both the incentive and the searched address. Only zones applicable to the address are shown, not all zones tied to the incentive in general.

💡 If an incentive has no associated zones, or if the searched address does not qualify for any applicable zones (i.e., the address is not a hit), the Zone Details tab will not be displayed.

Zone vs. Zone Data

This document is proprietary and confidential. No part of this document is to be reproduced without expressed written permission of Incentify.

- Zone: The broader classification, such as New Market Tax Credit Zones.

- Zone Data: The specific geographic area (polygon) that the zone is tied to, such as low-income census tracts.

The header and zone description are associated with the zone, while all details under Boundary Details correspond to the zone data.

💡 Hover over a zone data box in the Boundary Details section to highlight the corresponding polygon on the map.

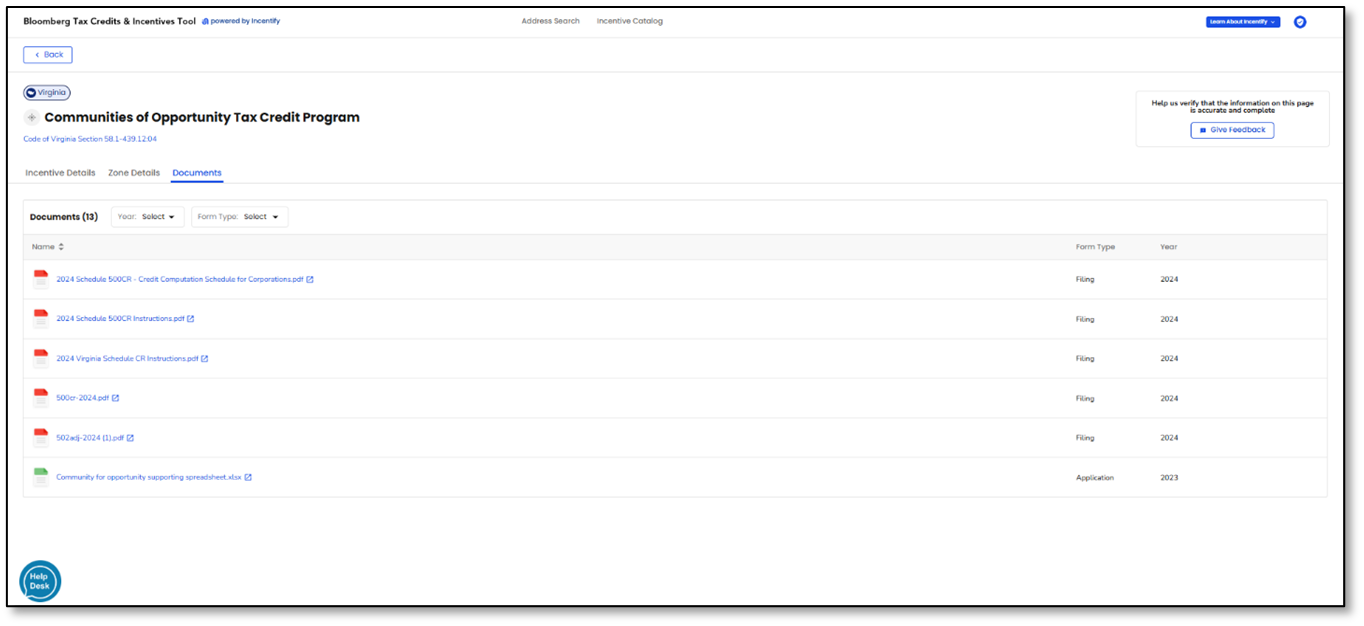

Documents

The Documents tab serves as a central hub for all available application and filing forms related to an incentive, spanning multiple years.

Features:

- Filter by Year or Form Type (Application or Filing).

- Download Forms: Click the link-out buttons to open documents in a new tab for easy downloading.

The Incentive Details tab also contains these forms, but only for the most recent years, not prior ones. If users need access to an older form, they can look for it in the Documents tab.

💡 If no relevant documents are available for an incentive, the Documents tab will not be displayed.

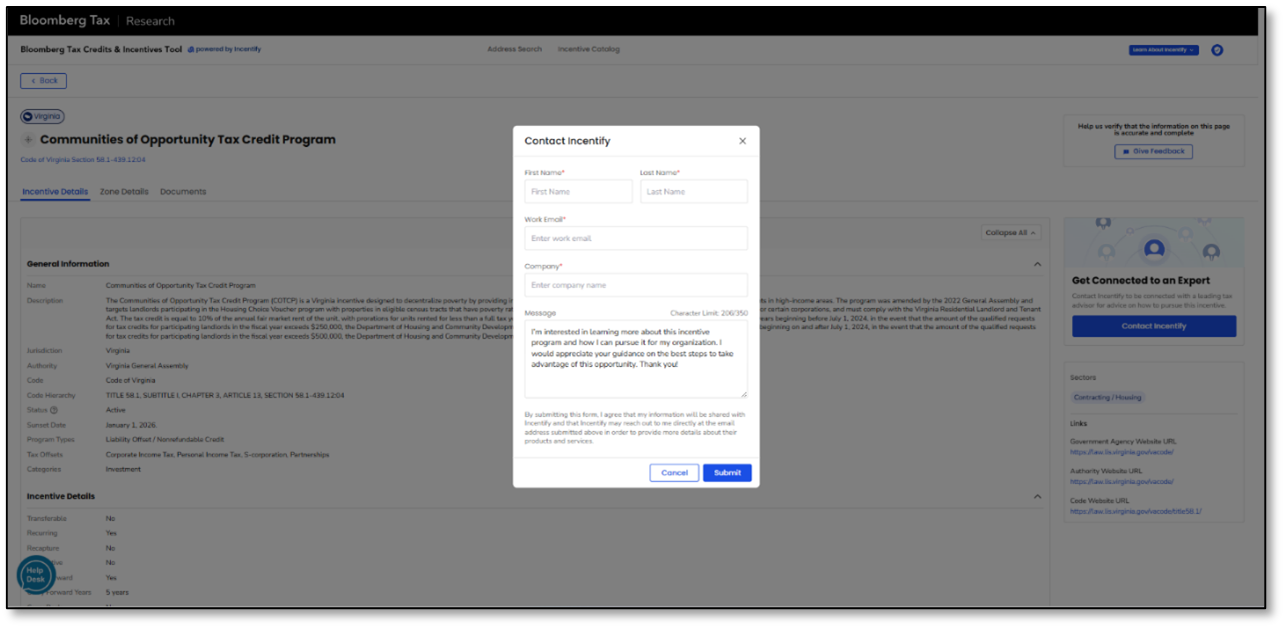

Get Connected to an Expert

The Get Connected to an Expert section and Contact Incentify button on the Incentive Details page let users connect with our team for program-specific questions and advisory services, not just upgrade inquiries.

How It Works:

- Click Contact Incentify on the Incentive Details page.

- Fill in the required fields:

- First & Last Name

- Company

- Work Email

(Optional) Edit the pre-filled message: "I'm interested in learning more about this incentive program and how I can pursue it for my organization. I would appreciate your guidance on the best steps to take advantage of this opportunity. Thank you!"

- Submit the request. Both Bloomberg Tax (incentify@bloombergindustry.com)and Incentify are notified.

- Incentify will follow up directly to discuss needs and next steps.

Catalog

The Incentives Catalog is a comprehensive, continuously updated database of tax credits, incentives, grants, and funds, accessible without entering a specific address.

Capabilities:

- Browse all available programs.

- View detailed incentive pages directly from the list.

- Apply advanced filters to narrow results.

Catalog Filters:

- Work similarly to the filters in the Single Address Search results list.

- Key differences:

- No zone filters (since the Catalog is not tied to an address).

- Shows all available sectors, categories, program types, and tax offsets, because it contains the complete database, unlike the address search results, which display only relevant filter options.

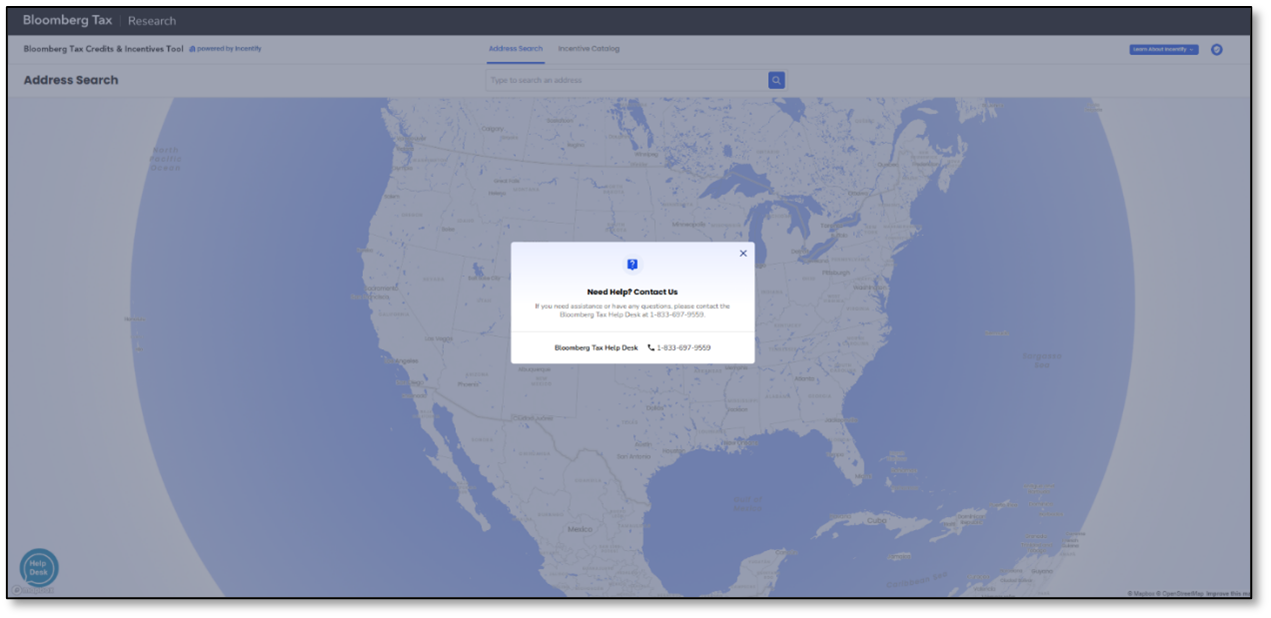

Contact & Support Options

Users can connect with Bloomberg Tax (incentify@bloombergindustry.com) or Incentify through multiple contact points within the platform.

Bloomberg Tax Help Desk

Users can click the Bloomberg Help Desk icon in the bottom-left corner of any page.

A modal displays the Bloomberg Tax Help Desk phone number.

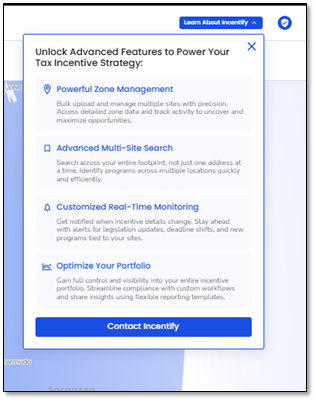

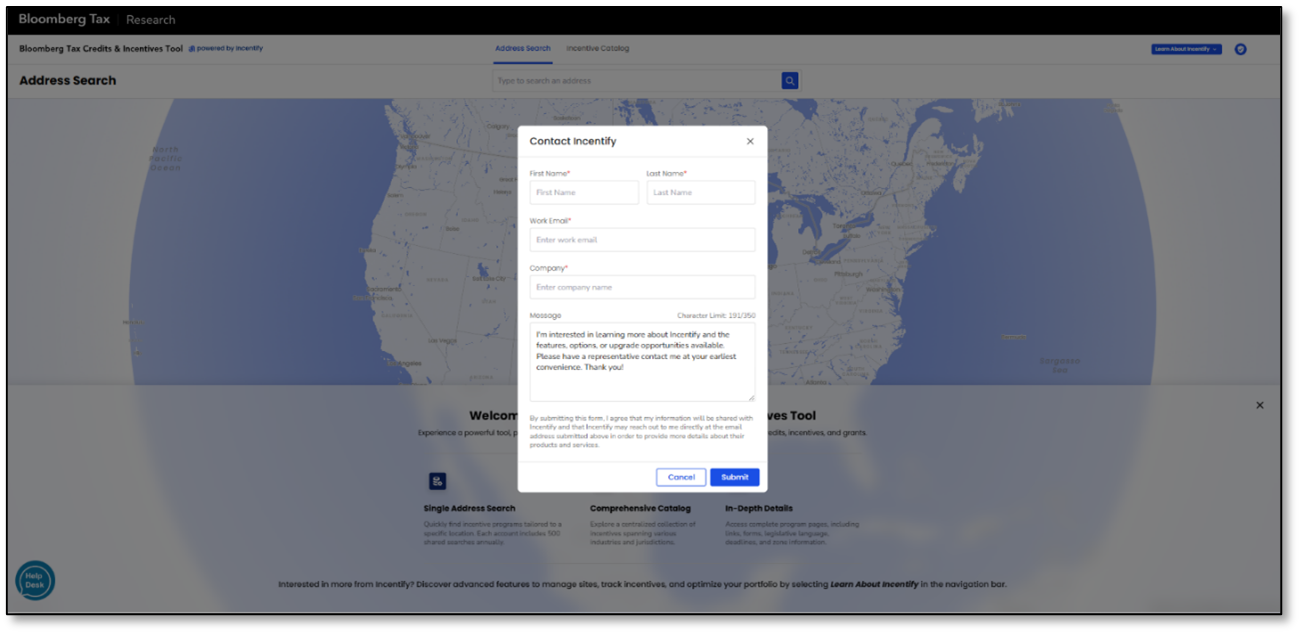

Contact Incentify

For upgrade inquiries or general product questions, users can contact Incentify through the dropdown in the navigation bar.

How It Works:

- Click Contact Incentify.

- Provide:

- First & Last Name

- Company

- Work Email

(Optional) Edit the pre-filled message: "I'm interested in learning more about Incentify and the features, options, or upgrade opportunities available. Please have a representative contact me at your earliest convenience. Thank you!"

- Submit the request. Both Bloomberg Tax (incentify@bloombergindustry.com) and Incentify receive a notification, and Incentify will follow up to assist them.

Email Received

When a user submits a contact request, a notification email is sent to:

- hello@incentify.com

- incentify@bloombergindustry.com \ No newline at end of file